Introduction to the Bank of India (BOI) education loans for studying abroad

Bank of India is one of the leading public sector banks in India. It offers education loans to students who are looking to study in India or abroad. With over 5100+ branches in India, BOI is well spread across the country, in all the states and union territories. The Bank of India education loan is designed to help students cover their educational expenses, including tuition fees, travel costs, and living expenses, making it easier for them to pursue their dream education abroad.

In this review of Bank of India’s education loan, we will understand everything about the product, including its interest rates, application process, eligibility criteria, and more. Keep reading to find out.

About education loans from the Bank of India

The Bank of India offers multiple education loans for students to study in India as well as abroad. These include the STAR Education Loan, STAR Vidya Loan, STAR Progressive Education Loan, and Star Pradhanmantri Kaushal Rin Yojana.

This guide is focused on loans for students seeking to study abroad, so we will focus more on the Star Education Loan Scheme from the Bank of India, which is aimed at these students. This education loan covers tuition fees, living expenses, accommodation fees, and program fees, including travel. Moreover, it offers competitive interest rates with a flexible repayment period of 15 years, which makes it an attractive choice among students.

Let us look into the interest rates offered by each loan product.

Interest rate of the Bank of India education loan for studying abroad

Here is the tabular representation of the loan plans of the Bank of India with their respective interest rates:

| Loan name | Interest rates per annum |

| STAR Education Loan (for study abroad) |

|

| STAR Vidya Loan | 8.95% |

| STAR Progressive Education Loan | 10.75% to 11.50% |

| Star Pradhanmantri Kaushal Rin Yojana | 8.45% |

| Star Education Loan – Working Professionals | 10.25% to 11.00% |

*RBLR stands for “Repo Based Lending Rate.” It is an interest rate benchmark used by banks in India, which is linked to the repo rate set by the Reserve Bank of India (RBI). The repo rate is the rate at which the central bank lends money to commercial banks. Banks use the RBLR to set their lending rates for various loan products, including education loans.

Application process for an education loan from Bank of India for Indian students

Follow these steps to secure an education loan from the Bank of India.

Step 1: Check eligibility

Visit the Bank of India’s official website and navigate to the “Star Education Loan – Studies Abroad” page. Eligibility criteria can change, so it’s important to review the latest requirements and ensure you meet them.

Note: We will explain the eligibility criteria for an education loan from the Bank of India, in a later section.

Step 2: Prepare all the required documents

Once you begin the application process, you must ensure all the required documents are ready. These documents include:

- Proof of admission

- Exam results from the qualifying exams

- The expenses of your scheduled study

- Proof of Identity (both Aadhaar and PAN ID)

- Proof of address

- Collateral security details and documents (if any)

- Academic records from 10th, 12th, and graduation (if applicable)

- VLP portal reference number

- VLP portal application number

- 2 passport-size photographs

You must also submit the following documents for your co-applicant:

- Aadhaar and Pan ID

- Proof of Address

- Income proof (such as ITR, Form 16, or last 6 months’ salary slips)

- 2 passport size photos

- 1 year bank statement

Make sure these documents are legible and up-to-date.

Step 3: Fill in the online application

Once you have the required documents ready, start filling out the loan application by providing information such as your name, date of birth, parent’s or guardian’s details, education details, financial information, etc.

Make sure you enter accurate details to avoid any roadblocks or delays in the loan application process.

Step 4: Submit your application and wait for a decision

Once you have filled out the application form, review it thoroughly for accuracy and submit it along with the necessary documents.

After successfully filling out and submitting the application and the documents, wait for the bank to review your application to decide whether you qualify for the loan. This waiting period can last around 1 to 2 weeks.

If your loan is approved, the bank will hand out a loan agreement document with all the loan terms such as repayment period, interest rates, and other charges associated with the loan.

If you’re satisfied with the loan terms, sign the agreement and pay the processing fees. Within 2-3 days, the bank will disburse your loan amount to your university.

Eligibility for the Bank of India education loan to study abroad

Before you apply for an education loan from the Bank of India, you must meet the eligibility criteria set by the bank. They are:

- You must be an Indian citizen holding an Indian passport.

- You must be 18 years of age or above. If you’re under 18, your parents must apply for the loan on your behalf.

- Students must have an admittance letter or proof of admission from their university abroad.

- You must have cleared 10+2 or any other equivalent examination.

- Your chosen stream of study must be approved or recognized by the local academic authority or regulatory body.

- Your selected university must be ranked within 3000 according to Webometrics or within the top 1000 universities ranked by the QS Top Universities.

- If you are taking a loan above 7 lakhs, the bank requires a co-borrower, collateral, and an assignment of the student’s future income for loan repayment.

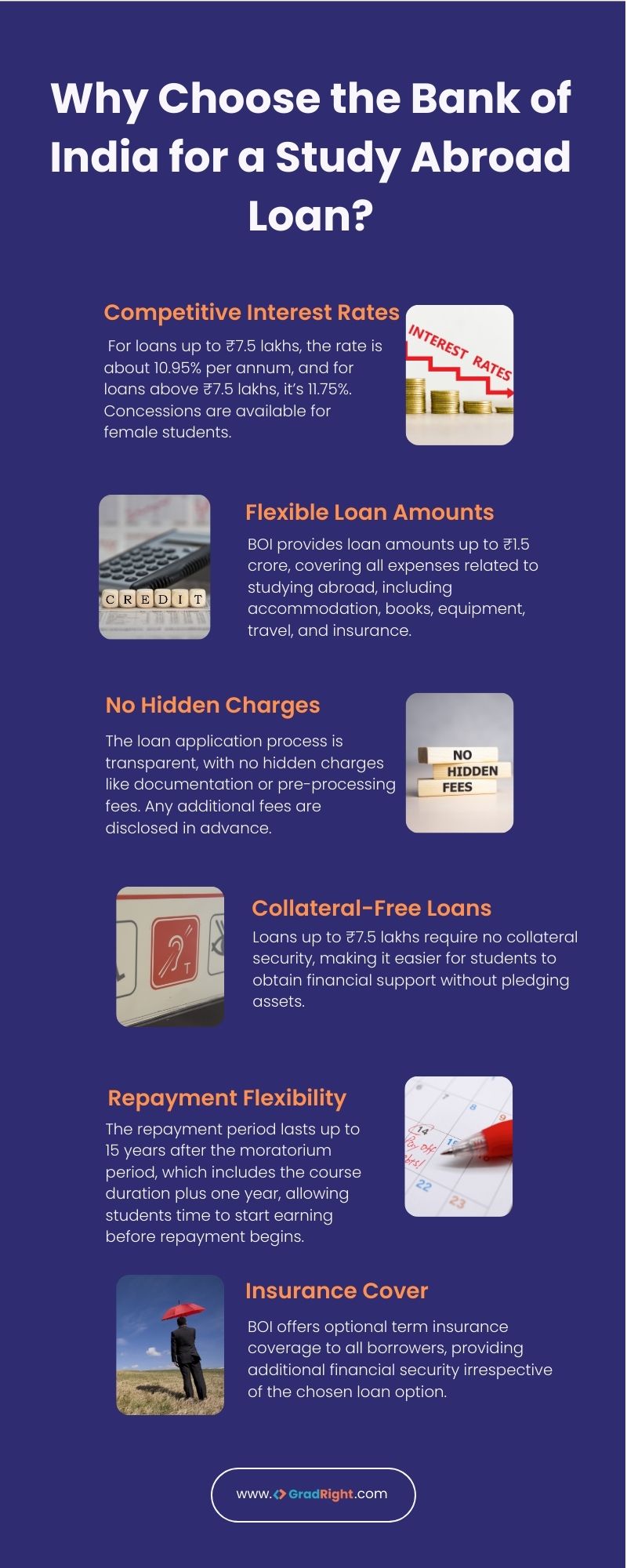

Why choose the Bank of India for a study abroad loan?

Bank of India’s education loan for studying abroad offers multiple features that make it an attractive choice among students. Here’s the list of the features that make it stand out from the other loan options:

Competitive interest rates

The Bank of India’s education loan interest rates are highly competitive. The interest rates are lower compared to other private banks or NBFCs in India. For loans up to ₹7.5 lakh, the interest rate starts from 1 Year RBLR + 1.70%, which translates to about 10.95% interest rate per annum.

For loans above ₹7.5 lakh, the interest rate is 1 Year RBLR + 2.50%, equating to 11.75%. Moreover, concessions are available for female students.

Note: These interest rates are true at the time of writing this guide (August 2024). For the latest interest rates, please check the official website.

Flexible loan amounts

The Bank of India can offer a loan amount of up to ₹ 1.5 crore to students looking to study abroad. This means the students can get a loan amount that is sufficient enough to cover their expenses of studying at top-ranked global universities.

BOI’s education loans cover all direct and indirect expenses of studying abroad, including accommodation fees like hostel charges or off-campus rent, books, equipment, travel, and insurance.

No hidden charges

The loan application process in the Bank of India is transparent and straightforward. There are no hidden fees like documentation charges or pre-processing charges. Other fees, if any, are in line with standard market practice. Students can expect the bank to inform them about these charges beforehand.

Collateral-free loans

The Bank of India offers loans up to ₹7.50 lakhs without any collateral or security. So the students can easily obtain the required financial loan amount without having to pledge assets or provide any collateral.

Repayment flexibility

For Bank of India education loans abroad, the repayment period lasts 15 years from the day when repayment starts after the moratorium period. The moratorium period for the Bank of India education loans lasts for the duration of your course plus a year.

This means you have one year after completing your studies before you officially start repaying the loan. Once the moratorium period ends, you have up to 15 years to fully repay the loan. This extended repayment term allows you to repay the loan comfortably.

Offered insurance cover

The Bank of India also offers optional term insurance coverage to all its borrowers, irrespective of the loan option chosen by them.

Other Banks & NBFCs Offering Education Loan to Study Abroad:

- Union Bank of India Education Loan

- ICICI Bank Education Loan

- Yes Bank Education Loan

- IDFC Bank Education Loan

- State Bank of India Education Loan

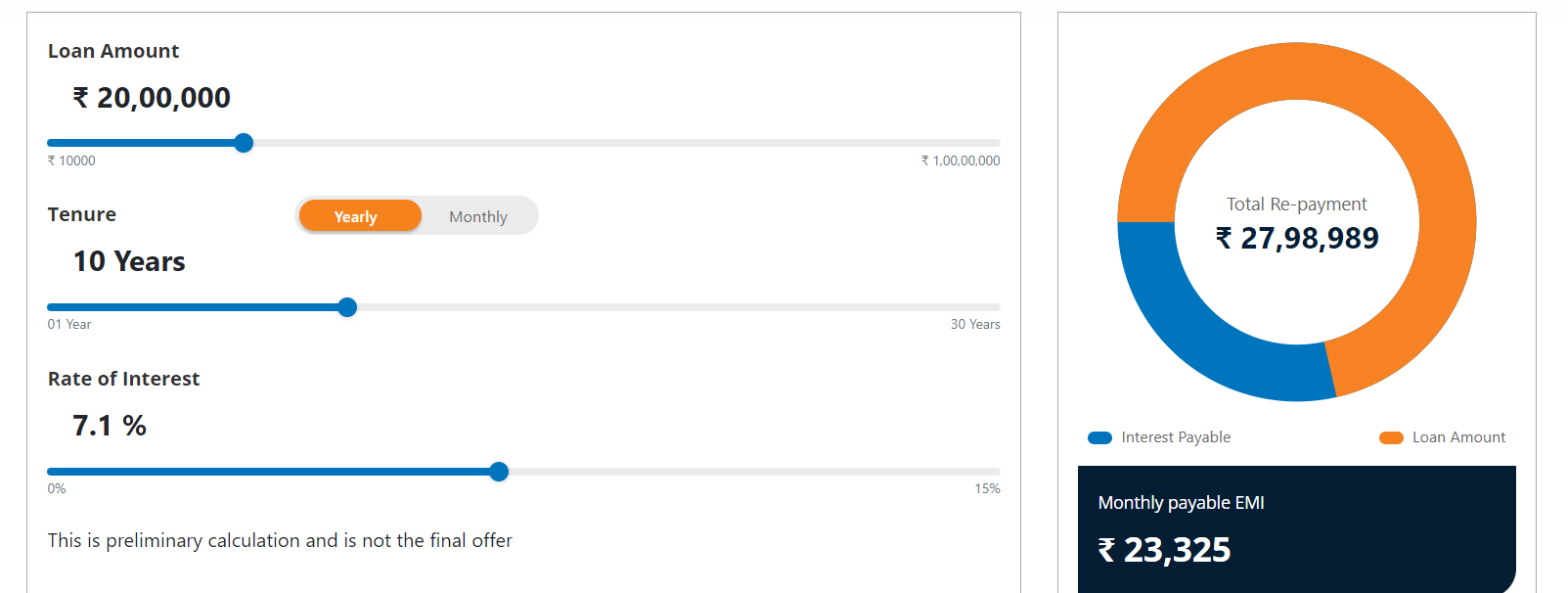

Bank of India Education Loan EMI calculator

The Bank of India education loan interest rate calculator is a useful tool that helps students calculate the EMI based on the following variables:

- The total sanctioned loan amount

- Repayment tenure

- Rate of interest

For instance, if you take a loan of ₹20 lakhs with an interest rate of 7.1%, to be repaid over 10 years, your repayable EMI is ₹23,325.

The loan calculator gives you information on the total amount that needs to be repaid, with the loan amount and interest amount highlighted separately. You’ll also get information on the EMI amount.

Documents required for securing a student loan from the Bank of India

The students must submit the following list of documents along with their application for an education loan from the Bank of India. These documents serve as proof of students’ academic and financial capability to study abroad.

| Document | Required For Student | Required For Co-applicant |

| Proof of Identity (PAN & Aadhaar) | Yes | Yes |

| Proof of Address | Yes | Yes |

| Income proof (ITR/Form 16/Salary slip) | No | Yes |

| Academic Records (X, XII, Graduation if applicable) | Yes | No |

| Proof of admission/qualifying examination result | Yes | No |

| Schedule of study expenses | Yes | No |

| 2 passport size photographs | Yes | Yes |

| 1-year Bank statement | No | Yes |

| VLP portal Reference Number | Yes | No |

| Collateral security details (if any) | No | Yes |

Things to remember when applying for Bank of India education loans

When applying for a Bank of India education loan abroad or in India, you must remember a few things:

Eligibility criteria

Before applying for an education loan abroad with the Bank of India, you must consider whether the bank recognizes your chosen university and program or not. Here is an overview of the criteria:

- Graduate Degree: Professional, technical, or any other graduate course.

- Postgraduate Degree/Postgraduate Diplomas/Ph.D./Masters: Conducted by recognized colleges/universities such as MCA, MBA, MS, etc., recognized by the respective academic authority/regulatory body of the country.

- Professional Courses: Courses like CIMA (London) and CPA (USA) for exam fees.

- Specialized Training: Regular Degree/Diploma courses like Aeronautical, Pilot training, and Shipping, provided these are recognized by local regulatory bodies and the Director General of Civil Aviation/Shipping in India for employment purposes.

- Government Education Loan Subsidy Schemes: Courses as initiated under various government schemes.

Note: If your chosen program is online, check whether the bank sponsors online or only full-time programs.

Choosing a university to study abroad is a crucial decision, and it’s equally important to ensure you can get funding from top banks for your education. Sometimes, checking so many boxes can become difficult for students, leading them to the wrong choice. This is where SelectRight can help.

SelectRight uses over 8 million data points from 40,000+ programs across 4,000+ universities worldwide to find programs that offer you a very high ROI, have a high chance of admission, and are easy to secure funding for.

Here’s how SelectRight works:

- Create a free profile on SelectRight and provide all necessary information about your academic background, test scores, and preferences.

- The algorithm processes your details and generates a shortlist of the best-suited universities and programs for you.

- Compare the shortlisted universities using advanced criteria such as alumni networks, recent placements, and faculty quality.

- Get help from an expert advisor at any stage of your application process.

- Connect with peers, alumni, and faculty from the shortlisted universities to get your questions answered and make informed decisions.

By using SelectRight, you can streamline your university selection process, ensuring that you make the best choice for your future education and career. Start shortlisting your programs and universities for Spring ’25 now to get ahead, with SelectRight.

Loan amount and margin

Before you decide on the total loan amount, be mindful of the margin the Bank of India requires. The margin is 15% of the loans for study abroad. Consider whether the loan amount covers tuition fees, accommodation, and other expenses including books, travel, exam fees, health insurance, etc. Considering all of these factors, determine the loan amount you need.

Tenure

When selecting the tenure for the Bank of India education loan, choosing carefully is important. You can opt for a repayment period of up to 15 years. While choosing a longer tenure means your monthly EMI will be lower, it also means that you will end up paying more in interest throughout the loan repayment period.

On the other hand, a shorter tenure will increase your monthly EMI but reduce the overall interest expense. So, you must consider your financial situation and future income prospects before deciding on the best tenure for you.

Moratorium

The moratorium is the period when you don’t need to make any principal repayments. In the case of the Bank of India education loan, the moratorium period can be extended up to 12 months.

Once you have considered these points and feel you meet the eligibility criteria, you can apply for the Bank of India education loan.

Collateral rules for the Bank of India education loans

The collateral rules set by the Bank of India are simple and based on the loan amount required by the students for their education loan abroad. Here’s the breakdown of the collateral rule set forth by the Bank of India.

For loan up to ₹4 lakh

Students who require loan amounts up to ₹4 lakh do not need to submit any collateral. They must have a co-applicant or a co-borrower who can be the applicant’s parents or guardians. They act as witnesses or the second point of contact other than the applicant. While no collateral is required for borrowing up to this amount, the co-applicant must ensure the loan is covered under the Credit Guarantee Fund Scheme for Education Loans (CGFSEL), which provides a security guarantee for the loan.

For loans between ₹4 lakh and ₹7.5 lakh

This option is quite similar to the smaller loan but still requires CGFSEL protection. Any loan amount between 4 and 7.5 lakh does not require the students to pledge any collateral. However, they must have a co-applicant or a co-borrower.

For loans above ₹7.5 lakh

Any loan amount of ₹7.5 lakh requires tangible collateral and financial credit history of both the applicant and their co-borrowers. They must also present collateral that proves to be a substantial assurance for the bank. The applicants must submit their co-applicants credit history, ITR, or salary slips from the last 6 months to qualify for the education loan to study abroad.

Collateral must have a suitable value to be accepted by the bank. You can keep fixed deposits or property as collateral.

Note: The Bank of India also accepts agricultural land as collateral. However, it is only acceptable in states where it is permitted to mortgage agricultural land for non-agricultural purposes. Hence, it’s advisable to check with the Bank of India regarding this matter, as agricultural land as collateral is subjected to various terms and conditions set by the bank.

Whether you’re choosing a bank loan with collateral or without one, it is extremely important to check the terms and conditions of the bank and then proceed to choose the loan. You can secure higher loan amounts from other banks, sometimes even up to ₹1.5 cr, with the same collateral. Additionally, many banks in India offer loans for amounts upto ₹1 cr without any collateral requirement. So, while the Bank of India does provide you with a great option, comparing different options based on different factors can help you get a loan that best fits your needs.

This is where FundRight can be of great help.

Secure the right education loan abroad with FundRight

FundRight is a platform that helps you find the best education loan. Here’s how it works:

- Create your profile on FundRight, and enter your academic and financial details.

- Within 2 days, receive offers from 15 banks and NBFCs in India and abroad.

- Compare lenders based on loan terms like interest rates, repayment periods, processing fees, etc.

- Get help from FundRight’s financial advisors, who will guide you through every step.

- Once you find your perfect match, upload your documents and a duly filled application form.

Don’t wait; start applying for your education loan for Spring ’25 today! Sign up on FundRight to secure the best loan options for your future.

Also Read: Collateral vs Non Collateral Education Loan for Abroad Studies

FAQs

Bank of India’s education loan covers a wide range of undergraduate and graduate courses for studies abroad, provided they are well-ranked and offered by reputable and top-ranked universities abroad.

The academic qualification required to apply for an education loan from the Bank of India is that you must have completed at least 12th grade. Additionally, you have secured admission to a recognized university or institution overseas, have a strong academic record, and meet the bank’s eligibility criteria regarding age, course selection, and financial background.

Yes, if you are pursuing an online degree or diploma program from a recognized university or institution abroad, you can avail of the Bank of India education loan to cover the tuition fees and other eligible expenses related to the online course.

No, there is no specific mention of a minimum aggregate score required to qualify for the Bank of India education loan for studying abroad. However, academic performance may be considered, but it is particularly regarding the student’s future employability.