Pursuing higher education dreams often comes with a significant financial burden. However, the Indian government recognizes the importance of education and offers valuable tax benefits to ease this burden.

This article explains the Section 80E education loan deduction available to students pursuing higher education abroad or in India.

What is an 80E education loan deduction?

The 80E education loan deduction is a tax benefit that allows you to reduce your taxable income by the amount of interest you paid on an education loan during the financial year.

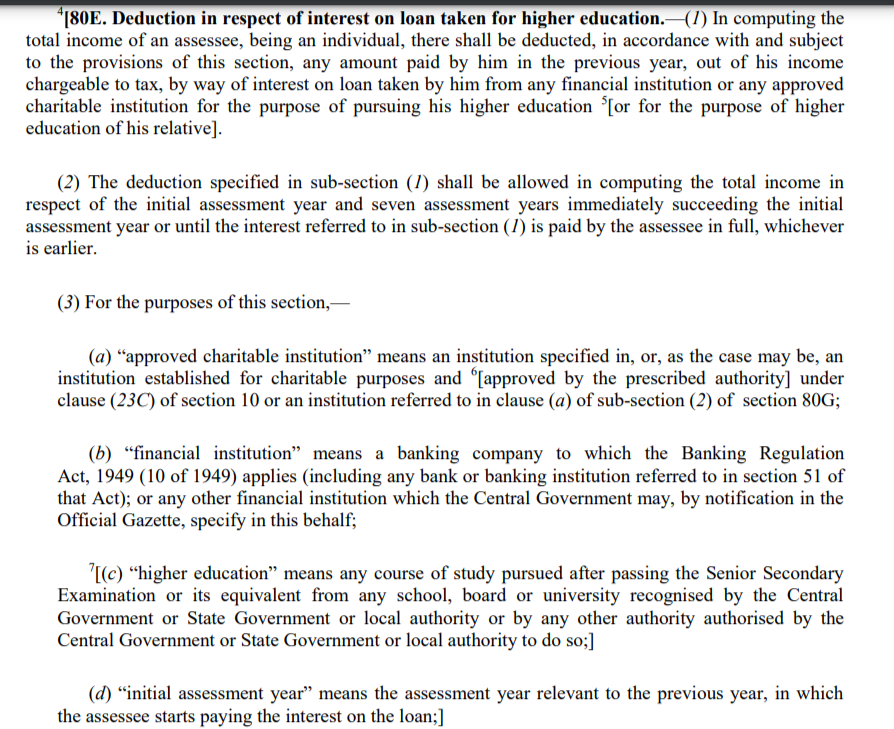

To truly understand every nuance of the section, one would need to read it carefully. Here is the verbiage of the section, as taken from the Income Tax Act.

![]()

However, students can easily understand all the privileges and caveats of Section 80E by reading this guide.

First, let’s understand why this income tax benefit has a huge impact. The most significant advantage of Section 80E is that there is no limit on the deduction you can claim for the interest paid on your education loan. Every rupee of interest you pay on your education loan during the financial year is eligible for deduction from your taxable income.

So, it’s clear that Section 80E is a valuable tax exemption designed to encourage individuals to invest in their, or their dependents’ higher education. You must keep in mind that there are eligibility criteria to avail of this exemption.

Eligibility for Section 80E deductions

To take advantage of the education loan tax benefit under Section 80E, you must meet certain eligibility criteria. Here is what you should know:

Eligible Individuals and Ineligible Entities

Individuals who have taken an education loan for their own higher education, or for the higher education of their spouse, children, or legal wards are eligible for the education loan exemption. Companies and Hindu Undivided Families (HUFs) are not eligible to claim this education loan deduction.

Purpose of the Loan

The education loan tax deduction is only applicable if the loan is taken to pursue higher education after passing the Senior Secondary Examination or its equivalent from any school, board, or university recognized by the Central or State Government.

The tax benefit for education loans under Section 80E applies whether the higher education is pursued in India or abroad.

This education loan income tax benefit is applicable for full-time courses for graduate programs in:

- engineering

- medicine

- management

and post-graduate programs in:

- applied sciences

- pure sciences

- mathematics

- statistics

The deduction is also applicable to vocational courses.

Approved Lenders

The education loan subsidy is only applicable if the loan is obtained from a financial institution to which the Banking Regulation Act applies, or an approved charitable organization established under section 80G of the Income Tax Act. If the loan is obtained from friends or relatives, it will not qualify for the Section 80E tax benefit.

Deductible component

The principal amount of the loan is not eligible for deduction under Section 80E. Only the interest component of the education loan can be claimed as a deduction.

Relevant tax regime

The Union Budget, 2023 has made the ‘new simplified tax regime’ the default choice for all citizens.

The education loan exemption can only be claimed by individuals who have opted for the ‘regular tax regime’ (old regime).

You may still opt to use the ‘regular tax regime’. However, in order to do so, you have to file Form10-IEA before filing your income tax return. You cannot avail of the section 80E exemption under the ‘new simplified tax regime’.

If you meet the aforementioned eligibility criteria, you must furnish certain documents to apply for the section 80E tax exemption.

Documentation to claim income tax deductions under Section 80E

To claim the tax deduction, you must obtain a loan sanction letter and certificate from an approved lender, clearly stating the principal and interest amounts paid on the education loan during the financial year.

The financial institution from which the individual has taken the loan will provide a certificate each year, stating the specific amount to the financial institution towards the interest on the education loan.

Although necessary, there is no need for immediate submission of these documents. You must, however, maintain these documents for scrutiny if the Income Tax Department requires so.

Period of deduction under Section 80E

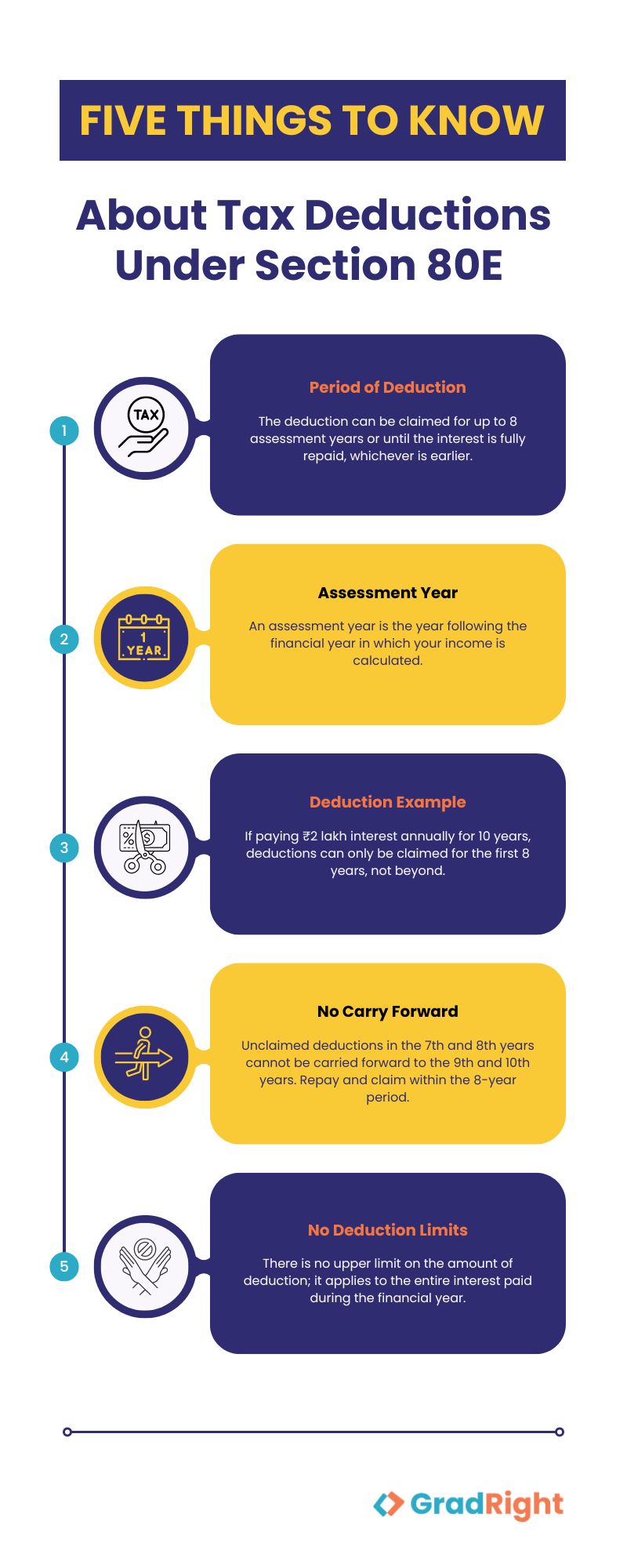

The deduction can only be claimed for a maximum of 8 assessment years or until the interest is fully repaid, whichever is earlier. The ‘assessment year’ is the year succeeding the financial year in which your income is calculated.

For instance, if you obtain an education loan for a four-year course, your repayments will typically begin 6-12 months after the completion of your course, depending on your employment status. You can only enjoy the tax benefit for the first 8 years, or until the interest is fully repaid, whichever is earlier.

For example, if you are liable to pay ₹2 lakh as interest on your principal amount each year for 10 years, you would want to repay the loan each year and keep on claiming the deduction for the first 8 years.

If you claim the deduction for the first 6 years and do not make any loan repayments for the 7th and 8th year, you cannot carry forward the deduction to the 9th and 10th year. Therefore, it is important to ensure that you make loan repayments and claim the deduction within the eligible period.

Once the 8-year window closes, no deductions are applicable. The interest payable after the 8-year window can’t be reduced from your taxable income for the purpose of tax calculations.

Now that you understand the duration of deduction, you must understand the limits and process of deduction as well.

Section 80E tax exemption limits

There is no limit on the deduction amount you can claim.

Unlike other deductions like Section 80C and Section 80D, Section 80E does not impose any cap on the deduction you can claim for the interest paid on your education loan. You can save the entire interest amount paid during the financial year as a deduction, regardless of the actual sum.

How does it work?

First, calculate your gross taxable income after claiming other eligible deductions, if any.

Second, determine the interest component paid on your education loan during the financial year.

Third, deduct this interest amount from your gross taxable income. The remaining amount, after considering other eligible deductions under the Income Tax Act, will be your taxable income for the year.

For example, if your gross taxable income after other deductions is ₹10 lakhs, and you paid ₹1 lakh as interest on your education loan in that financial year, your total income for tax calculation purposes would be reduced to ₹9 lakhs (₹10 lakhs minus ₹1 lakh). In this example, we’ve assumed no other deductions.

The following table helps you understand this better.

| Financial Year | Total Taxable Income (excluding tax-free income, and assuming no other deductions other than Section 80E) | Interest Rate Applicable | Interest paid on Education Loan | Taxable Income after Section 80E Deduction | Amount saved due to Section 80E |

| 2021-22 | ₹6 lakhs | 10% | ₹1,80,000 | ₹4,20,000 | ₹18,000 |

| 2022-23 | ₹10 lakhs | 15% | ₹1,50,000 | ₹8,50,000 | ₹22,500 |

| 2023-24 | ₹12 lakhs | 15% | ₹1,20,000 | ₹11,80,000 | ₹18,000 |

This unlimited deduction potential under Section 80E can result in substantial tax savings, making it easier for you to manage the financial burden of pursuing higher education.

Should you repay an education loan early?

Once you complete your degree and begin repaying your loan, chances are you’d have significant disposable income. In such a case, you might have to consider whether to repay your education loan early or to invest your money. The answer will depend on your financial goals, investment strategy, and many other factors (such as your tax bracket, expected returns on investment, etc.).

Here are some guidelines.

- If you are in a higher tax bracket, consider extending the loan repayment period to the full 8 years. This strategy allows you to claim tax deductions for a longer time, which could reduce your taxable income each year.

- If the returns on your investments are likely to be lower than the loan interest rate, or if you prefer a more secure financial situation, repay your loan early.

- Compare the interest rate on your loan with the returns from investments. If your investments are expected to yield higher returns (post-tax) than the interest rate on your loan (accounting for the tax savings under Section 80E), invest your surplus income.

- Repaying your loan early or on time can improve your credit score. This can be advantageous if you plan to apply for other types of loans, like a home loan, in the future.

While we’re on the subject of smart finance, here’s something that could save you lakhs on the interest expense of your education loan.

FundRight – Find your best education loan

FundRight is a one-stop platform that simplifies the entire education loan process. Here’s how it works.

- Sign up on FundRight

- Create your student profile

- Compare education loan offers from 15+ top Indian and international lenders

- Upload your documents

- Get help from a financial expert to negotiate the most suitable terms

- Get your loan approved in as few as 10 days

FAQs

Can I claim a deduction for the principal amount and the interest amount?

No, you cannot claim a deduction on the principal amount under Section 80E. This deduction is only applicable to the interest component of your education loan.

Can I claim a deduction on the interest amount if I opt for the new tax regime?

No, the education loan subsidy under Section 80E is only available if you opt for the regular (old) tax regime.

Can I claim a deduction if I borrowed money from my friends or family but the purpose is purely educational?

No, only loans offered by registered banks and charitable organizations are eligible for the deductions under Section 80E.

Can I claim a deduction after the 8-year window is closed if my repayment is still ongoing?

No, only payments that are made within 8 years after they begin are eligible for education loan deduction under Section 80E of the Income Tax Act.