“I can’t study in the USA because my parents are not rich.”

As an Indian student, if you have always dreamt of studying in the US, here’s good news for you! You don’t need to have super wealthy parents to be able to pursue higher education in the USA.

Several US education loans are available for middle-class Indians who wish to study abroad. You can get it too.

But, we understand that getting an education loan to study abroad is not as easy as it sounds. Finding the right loan can be a tough task since there are 100+ banks and thousands of schemes. But guess what? You don’t have to go through this process with FundRight.

GradRight helps you secure the right education loan with the most competitive interest rate to get admission to your dream university in the US. But more on that later.

So, let’s discuss more about the education loans for Indian students to study in the US.

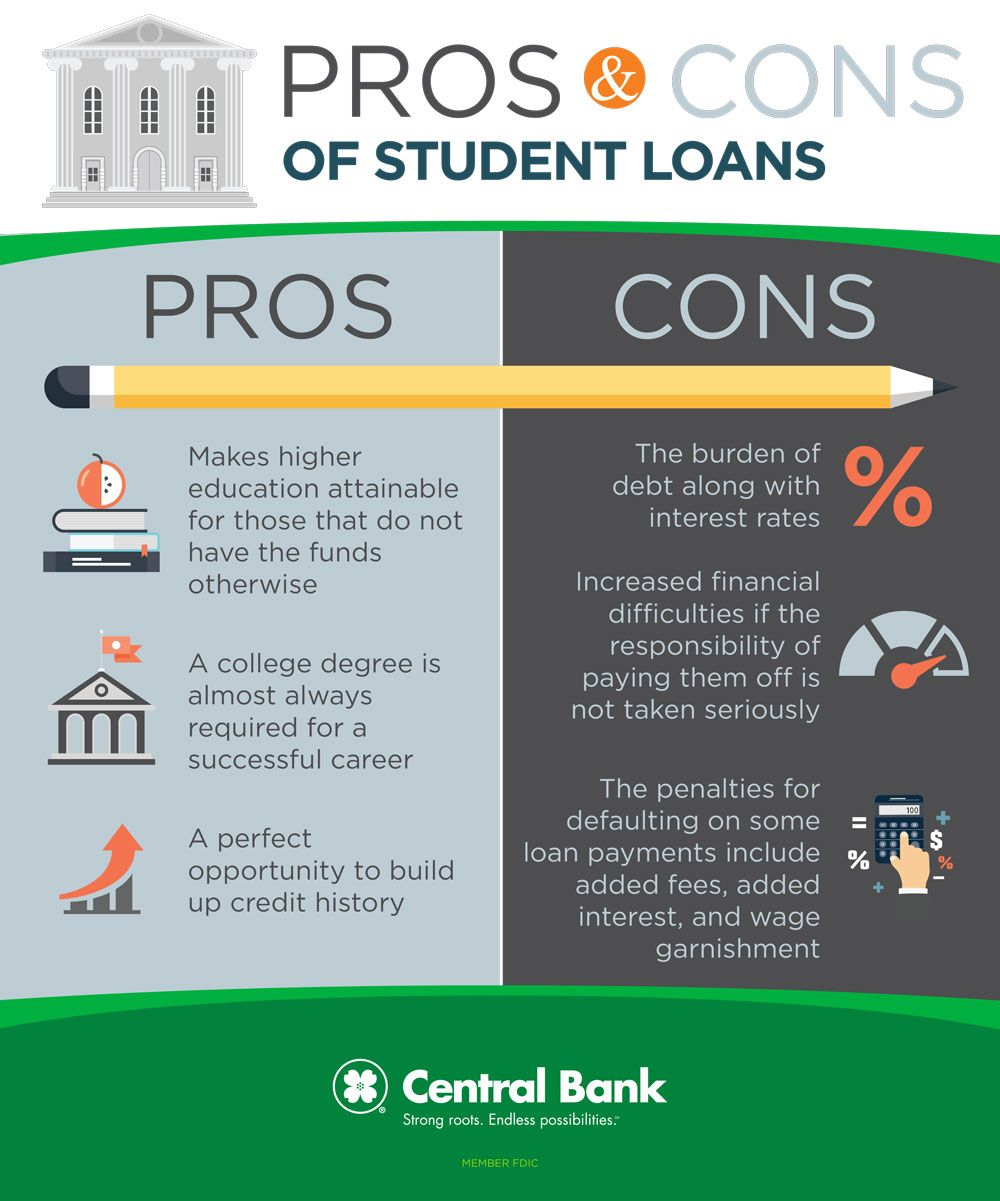

Is Taking an U.S. Education Loan A Right Option?

This question plagues lots of Indian students wanting to pursue a Masters in the US.

So, what to do? Should you give up your dream of doing a Masters in the US than to take out an education loan. The answer depends on your situation. Here are some questions you can consider.

Does the field you are choosing have job security?

Consider this. Which field has more jobs? Technology or Arts? Of course, technology. So, if you choose technology, you can have much better options for a job as soon as you get out of college. This means you can start paying your EMIs sooner!

Do you have a safety net?

Life is unpredictable. Things may change dramatically by the time you complete your MS. Consider the pandemic. Students who graduated during the peak of the pandemic didn’t have many job opportunities since companies were downsizing. Many students who had a job in hand had their joining delayed. However, these students still had a loan to pay! In such cases, the safety net is critical. Having a safety net would help you avoid spiraling down in negative debt.

Cost of Studying In the USA For Indian Students

When getting a loan, must consider all the expenses apart from tuition fees. This includes food, transportation, accommodation, hygiene, and clothing. Table below provides an approximate cost of living in the US. Many Indian students also do part time jobs considering they follow rules laid by student visa.

| Expense Categories | Expenses |

| Tuition Fees | Anywhere between $10,000 to $40,000 for two years. |

| Housing/ accommodation | Ranging between $900 to $1500/month |

| Utilities (Electricities, gas, heating) | $140/month |

| Transportation | $100/month |

| Food | $50/week |

| Personal Hygiene | $200/month |

| Clothing | $100 |

For more in-depth information, you can read our blog about the cost of studying in the USA for Indian students.

How To Compare Offers For Education Loan in the USA As An Indian Student

Education loans in the USA for Indian students come in different forms. Before finalizing the first loan you get, ensure that you’re getting the best deal by comparing the loans with these parameters.

- Interest rate. Even a 1% difference in interest rate can make a huge difference.

- Processing fees. Generally, banks have processing fees starting from 10,000 INR and above.

- Loan Margin. It is important to remember that banks never pay the total amount. There is always a minimum margin. For example, with a 10% margin, the bank will provide 90% of the cost; you must arrange the rest yourself.

- Loan processing time. Loans have different processing times depending on the bank. Unsecured loans are processed faster than secured loans.

- Repayment terms. Generally, repayment starts after completion of the course. However, for some banks, it starts within 6 months of loan approval.

- Maximum loan repayment term. Generally, you get 5 to 7 years to repay your loan. However, if you cannot repay your loan within a set period, you will get an extension.

The research process for education loans in the USA for Indian students can be time consuming. But, we have good news for you. You can cut the research time completely with us.

We’ve designed FundRight to help you. FundRight does the heavy work for you, including choosing the banks and researching the best loans based on your financial condition and college expenses.

Education Loan In the USA for Indian Students : Two Types You Should Know

There are two types of education loans. Secured and Unsecured loans. Let’s learn more in detail.

Note: These distinctions aren’t specifically for U.S. education loans (for Indian students). They apply to all loans.

What is a Secured – With Collateral loan?

A secured education needs a guarantee of collateral from the borrowers or co-signer. But what’s collateral? Collateral is an asset that’s tangible or intangible. Tangible assets include land, flats, homes, etc., whereas intangible assets include fixed deposits and insurance policies.

What is an Unsecured Loan- Without Collateral?

Simply said, an unsecured loan is where you do not need to pledge collateral. As said earlier, collateral is an asset. However, unsecured loan lenders demand a co-signer to approve a loan. Based on the credit or income of the co-signer, the loan is sanctioned. So, what’s the catch here? It’s higher interest rates! Since banks are taking the risk of not taking collateral, the interest rates are on the higher side, sometimes reaching above 13%.

Secured and Unsecured US Education Loan: What’s The Right Choice For You?

As you can see, both loans have advantages and disadvantages. Ultimately, the final decision will depend on various factors such as financial conditions, availability of collateral, etc.

| You should get a secured loan when: | You should get an unsecured loan when: |

| When you have collateral, such as agricultural land, fixed deposits, or a flat home, and are confident that you would be able to repay the loan. | You do not have suitable collateral or do not want to risk the collateral. |

| If you want to borrow more than 50 lakhs, you could borrow up to 1.5 crores. | The amount you are borrowing Does not exceed the threshold set by banks. |

| The approval process can take a long time. | You do not have time to wait for a lengthy approval process and need a loan urgently. |

| You want a moratorium period after course completion. | You can start paying your loan EMI within 6 to 12 months of loan approval. |

Eligibility Criteria To Qualify For Education Loan in the USA As An Indian Student

Before applying for an education loan in the USA as an Indian student, you must consider your eligibility. Here are the essential eligibility criteria to get a US education loan.

- You should be an Indian citizen.

- You must have a solid academic background. Remember, banks don’t want to take any risks.

- Your course must be job-oriented or technical in nature.

- You must have already secured admission to a recognized US university.

- You should be aged 18 years or above.

Learn more about the eligibility criteria for US education loans.

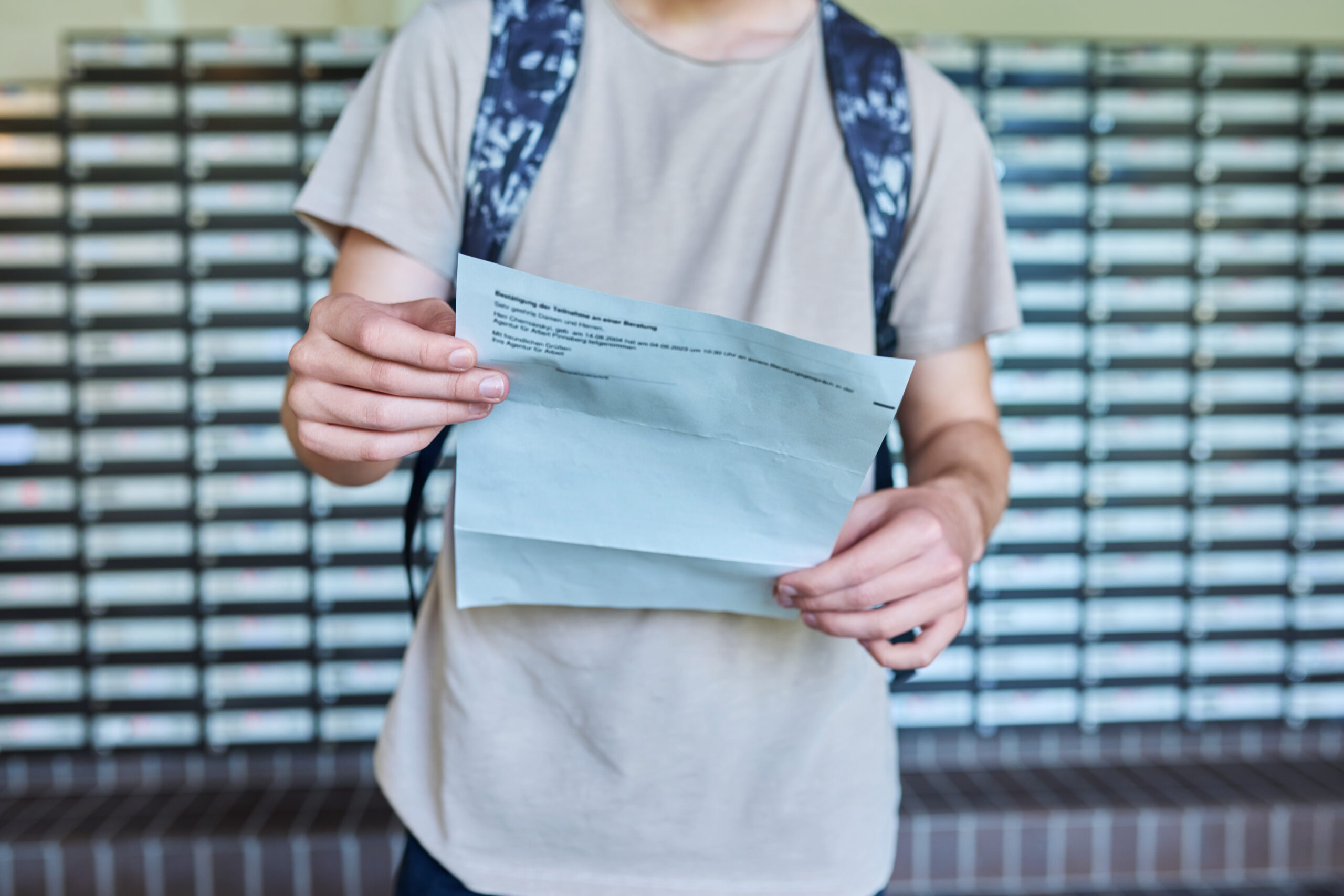

Documents Required To Get Education Loan In The USA As A Indian

Before sanctioning a loan, banks will assess your capability of repaying the education loan in the USA as an Indian student.

The following is a list of essential documents required for an education loan:

- Offer letter provided by the university

- Your loan application form

- Approximate cost of education

- Original education mark sheets and certificates

- Documents of Exams ( GMAT, TOEFL, or other qualifying exams)

- Residential Proof of the student

- Pan card of the student

- Passport copy

- Details of liabilities of the parents or guardians ( required only if the loan is a secured loan)

- Income proof of cosigners ( required only if the loan is secured loan)

What Expenses Education loan in the USA for Indian Students Cover?

Although an education loan in the USA for Indian students covers most of your expenses of studying, it won’t cover them all. The expenses covered would vary from one lender to another.

Here is the list of essential expenses you encounter while studying in the US.

- Fees for college and hostel or living

- Library fees, exam fees, and laboratory fees.

- Purchase books and other college stationery.

- Purchase of laptop ( only if required)

- Insurance premium ( only if required)

- Traveling expenses

- Miscellaneous expenses (including thesis, project work, industry visits, etc.)

Procedure For Applying For Education Loan In the USA for Indian Students

Admission process in most US universities starts in October. Hence, you must select an education loan before that. Here’s what the education loan process looks like:

Stage 1: You get your acceptance letter. You can now apply for a loan directly through the bank or lender.

Stage 2: If the loan criteria are fulfilled, the student is deemed fit for the loan. The loan is sanctioned.

Stage 3: Sanction letter is then sent to the university to get the I-20 form. It’s an important document without which you cannot apply for a student visa from the US embassy.

Please note:

- I-20 does not guarantee a US student visa. You must pass all the eligibility Criteria set by US authorities to get a student visa.

- Another issue many students will face is that some banks will ask for I-20 to sanction the loan. However, getting I-20 before the sanction letter is impossible because universities need a sanction letter to provide an I-20.

In contrast, students who apply through FundRIght won’t have to worry about handling the loan process. We do that for you, so you can do what’s meaningful.

How Can GradRight Help With Getting Education Loan in the USA for Indian Students?

First of all, let’s understand what FundRight is. FundRight is the India’s first (and only) online loan bidding platform in which banks bid on each other to provide you with the most competitive interest rates and loan facilities.

We know you’re thrilled to study in the US as an Indian student. The USA offers many career growth opportunities, but you can’t forget that the US is costly and would probably need an US education loan to study there.

But, GradRight wants you to focus on preparing for exams and not spend 720 hours researching loans and negotiating the best offer. We do that for you!

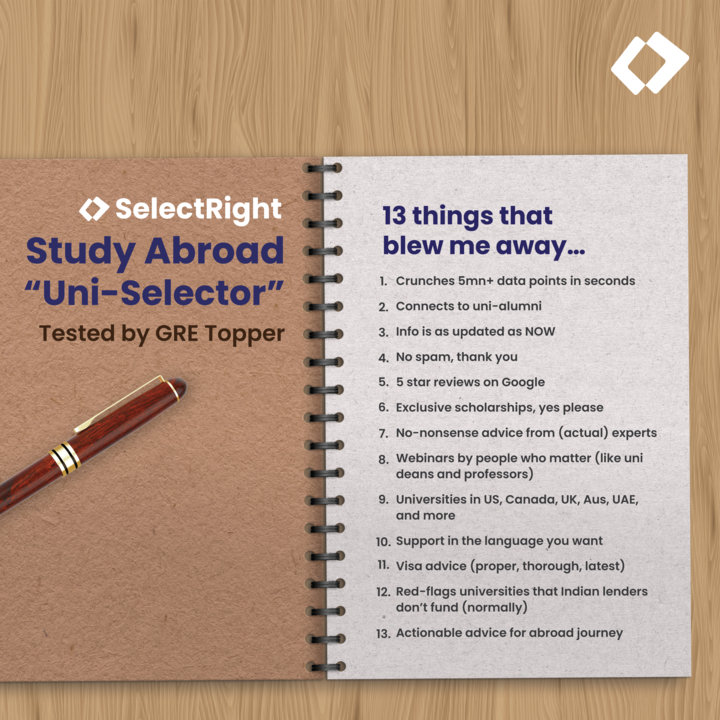

Select the Right University with SelectRight. There are thousands of universities in the US; where should you apply? SelectRight solves this dilemma by helping you shortlist the best university through comprehensive data of 5000+ databases.

Get the Best Loan customized only for you! FundRight reduces your loan research and negotiation hours to just 2 days! Banks compete with each other to offer you the best option.

Frequently Asked Questions

Question 1: How much US education loan can I get to study in the USA?

Answer: It depends. However, the maximum loan you can get to study in the USA is 1.5 crore with collateral. The repayment term varies based on the bank’s policies..

Question 2: How much money do I need to study in the USA?

Answer: According to Business Standard, a Master’s degree could cost you anywhere near 50 lakhs for two years. However, the amount of money you will need to study in the USA depends on several. factors.

- Do you have a scholarship? Scholarships can cover the majority of tuition fees.

- What’s your degree or specialization? Technical or very specialized courses cost more.

- What’s the location? States like California and LA have a higher cost of living than Texas.

Question 3: How long does it take to repay an MS education loan?

Answer: The repayment term is generally around 7 to 10 years with a maximum of 2 years extension. Nevertheless, with unsecured loans, repayment starts within 6 months, so you must start paying within 6 months of loan approval.

Question 4: Is an U.S education loan interest-free ?

Answer: Unfortunately no. An education loan is not interest-free. You will have to pay up to an 8% interest rate per annum for secured loans. For an unsecured loan interest, rates are upwards of 13% per annum.

Question 5: Can I get a US education loan without property?

Answer: Yes. You can get an education loan without collateral (property, fixed deposits). This is called an unsecured loan.